📌 Read More: Why the Share Subscription Agreement Is a Deal-Maker’s Playbook

While the Term Sheet sparks intent, it’s the Share Subscription Agreement (SSA) that seals the deal—making it enforceable under Indian law.

✔️ Understand how SSAs trigger key legal compliances under the Companies Act and FEMA

✔️ Explore investor protections—from reps & warranties to indemnity and anti-dilution

✔️ Learn how courts interpret clauses like ROFR, put/call options, and dispute resolution

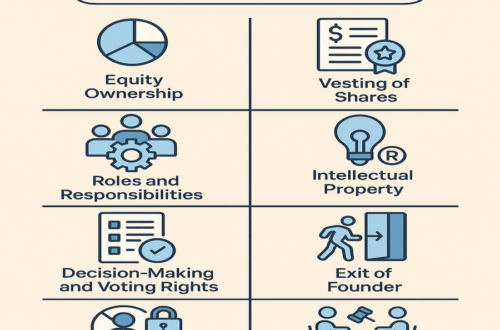

✔️ Get clarity on drafting milestones, vesting schedules, and CP timelines

💼 Whether you’re a founder raising capital or an investor safeguarding downside, this guide explains how to structure, enforce, and de-risk your SSA like a pro.

👉 Download our model Share Subscription Agreement here for practical reference and deal readiness.

Pages: 1 2

Thank you for this post, it helps with the basics.