Overview

June 2025 saw a decisive shift in private equity and venture capital activity in India. The focus moved toward large control transactions, strategic exits, and sector-specific bets. Healthcare led the charge. Torrent Pharma acquired JB Chemicals for $3 billion, making it one of the largest pharma deals in India. Manipal Health’s $800 million bid for Sahyadri Hospitals, with interest from global firms like EQT and TPG, reinforced investor appetite for long-term ownership in healthcare delivery.

The exit environment also strengthened. Flipkart exited ₹1,250 crore worth of stakes in Blackbuck and ABFRL, while EQT-backed Credila filed for a ₹5,000 crore IPO. These moves reflect rising public market confidence. Meanwhile, fintech players like Cred, Easy Home Finance, and Stable Money secured capital despite tighter regulations and valuation corrections. Udaan closed a flat $114 million round, signaling a shift toward sustainability over aggressive growth. New fund announcements by HealthKois and Inflexor Ventures showed that capital is now chasing deep sectoral expertise, not just scale.

Private Equity/ Venture Capital Deals Snapshot

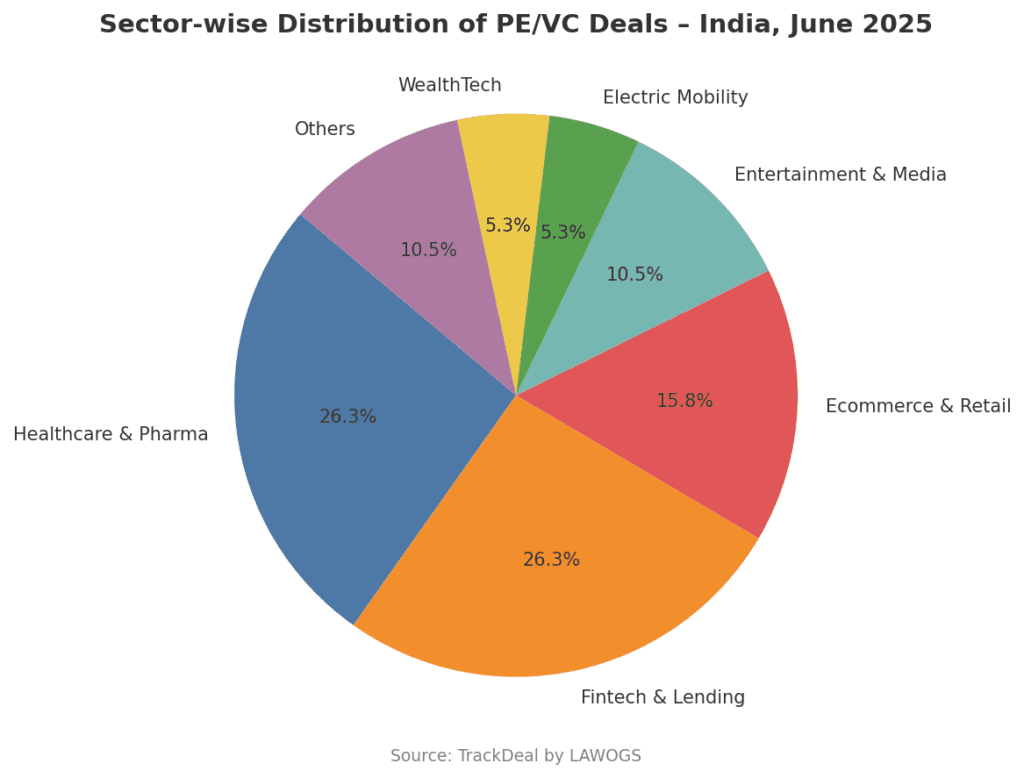

The pie chart above captures the sectoral distribution of June 2025 deals. Healthcare & Pharma and Fintech & Lending together accounted for nearly 60% of all transactions. Pharma topped in deal value, with Torrent and Manipal leading the way. Lending platforms drew investor interest thanks to their secured asset base and scalable models. Ecommerce and retail, including Udaan and Flipkart’s exits, followed closely. Entertainment and digital content startups, like Zee-backed Bullet, added diversity, while electric mobility and climate-health ventures hinted at next-gen investment themes.

Private Equity/ Venture Capital Deal Table: June 2025

What This Means?

The June activity reflects a more mature and calculated investment approach. Investors are showing a clear tilt toward control deals, exit pathways, and sector depth. Liquidity events like block deals and pre-IPO filings suggest improved recycling of capital and growing public market trust. Fundraising is increasingly tied to viable business models, strong governance, and regulated markets. The narrative is shifting from “growth at all costs” to “sustainable, strategic growth with clear monetisation outcomes.”

Most importantly, PE/VC capital is flowing where sectoral conviction and regulatory visibility align. Whether it’s healthcare consolidation, fintech rebounding under tighter norms, or consumer platforms realigning cost structures, June made one thing clear: India’s investment story is evolving from volume to value.

Pages: 1 2