July 2025 kept the private equity investment momentum going with a mix of mega secondary transactions, growth-stage bets, and niche early-stage plays. The highlight was Brookfield and EQT’s potential $3 billion acquisition of Gland Pharma from China’s Fosun Group, marking a significant strategic shift in the healthcare sector. Orix’s $1.28 billion exit from Greenko Energy, paired with a reinvestment of $731 million into AM Green, showcased long-term bullishness in India’s clean energy ecosystem. On the consumer side, ChrysCapital acquired a majority stake in Theobroma for $290 million, signaling private equity’s growing appetite for brand-led FMCG and retail stories.

Mid-size and early-stage deals also remained active. Notable among them were Zango AI ($4.8M), Gupshup ($60M), and Transvolt Mobility ($20M)—each playing into deep tech, AI, and EV narratives. The food and wellness segment continued to attract steady capital, with Khetika, Zeus Hagia, and SuperK raising funds for expansion, brand-building, and Tier III retail. Overall, July reflected a balanced portfolio of scale, sustainability, and strategic exits, with pharma, EVs, clean energy, and consumer retail leading the way.

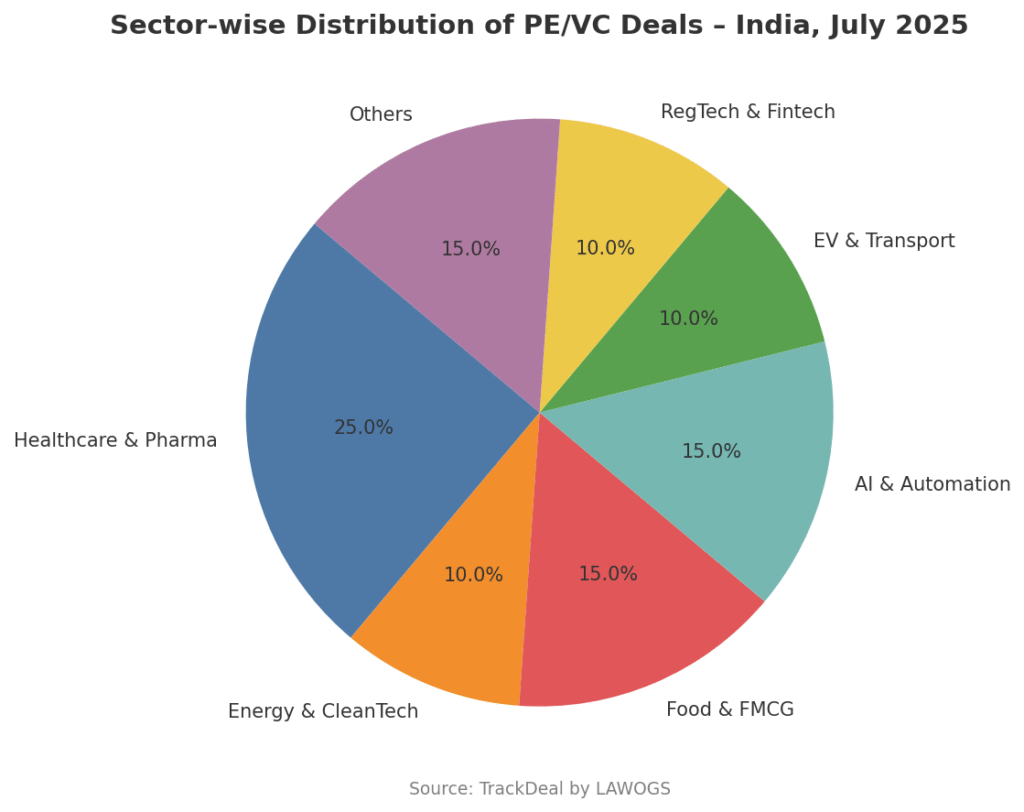

The chart shows a diverse sectoral spread, with Healthcare & Pharma leading once again, driven by the $3 billion potential acquisition of Gland Pharma and the Bain Capital exit from Amcure. This marks the third consecutive month where healthcare has commanded the top spot in terms of both value and volume.

Energy & CleanTech, led by Orix’s $1.28 billion exit from Greenko and its reinvestment in AM Green, emerged as a significant vertical reflecting strong institutional interest in India’s renewable future. Food & FMCG also had a strong showing, thanks to ChrysCapital’s acquisition of Theobroma and growth capital into Khetika and SuperK, indicating PE appetite for branded, consumer-led platforms. Notably, AI & Automation (Gupshup, Zango AI, Enlite) continued to gain investor attention, while EV & Transport saw sustained interest via Transvolt Mobility and aerospace startup Inbound. The “Others” category, which includes wellness, OTT, and Edtech, underscores the ecosystem’s ongoing experimentation with emerging and culturally relevant models

Track Deal Comments

July confirmed a few critical trends. First, investors are getting more strategic with exits and re-entries—as seen with Orix and GIC in clean energy. Second, healthcare and pharma remain core sectors, with back-to-back billion-dollar deals for three months in a row. Third, AI, EVs, and retail chains targeting non-metro India are quietly gaining traction as themes with long-term depth.

From a capital perspective, the market is now allocating intelligently big money is going into proven themes (like pharma and energy), while early-stage bets are focusing on future tech and regional consumption. The ecosystem is steadily shifting from “startup momentum” to “institutional maturity”, where exits, control, and compounding value drive decisions—not just scale.

Trends from May to July:

- May 2025 focused on broad-based sectoral growth. Healthcare deals like PB Healthcare ($218M) and wellness startups like The Good Bug stood out. Universal Studios’ $794M India entry and Porter’s unicorn round captured headlines.

- June 2025 shifted to control transactions and liquidity events. Big-ticket moves like Torrent Pharma’s $3B acquisition of JB Chemicals, and Flipkart’s ₹1,250 crore block exits showed maturity and capital rotation. It was a month of consolidation and public market optimism.

- July 2025, in contrast, revealed a renewed tilt toward energy, clean tech, and consumer brands. It was defined by large exits (Orix-Greenko, Gland Pharma), brand-focused acquisitions (Theobroma), and global themes like AI and sustainability.

Private Equity/ Venture Capital Deal Table: May 2025

Pages: 1 2