In the realm of PE VC transactions, the termsheet and the definitive agreements are foundational.

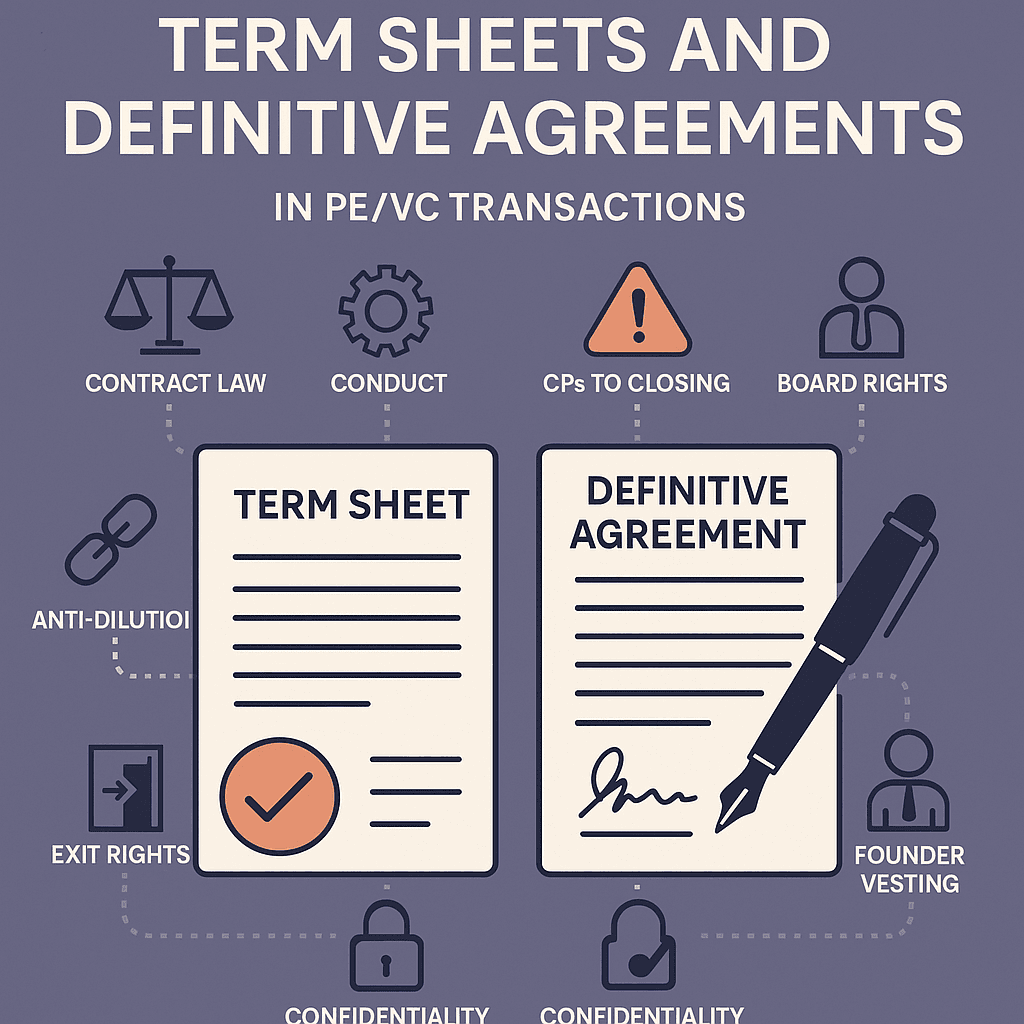

A termsheet (“See IVCA Model Termsheet”) is a preliminary document that sets out the broad contours of a proposed investment, amount, valuation, rights, and exit preferences. It is typically marked non-binding, except for clauses like confidentiality, exclusivity, and dispute resolution.

However, Indian jurisprudence suggests that labels alone don’t determine enforceability. In Zostel v. OYO (Delhi HC, 2025), the court emphasized that unless parties agree on all material terms, a term sheet—even if partially acted upon—does not become a binding contract. This reinforces a long-standing position: “agreements to agree” are not enforceable under Indian contract law, unless there’s consensus ad idem and definitive intent.

Still, binding clauses—especially those covering exclusivity, no-shop obligations, and confidentiality—can be enforced independently, as seen in Welspun One Logistics v. Brilliant Corporate Services (Delhi HC, 2022).

Common terms under a termsheet:

| Term | Comments |

| Investment Amount and Equity Stake | Though commercially negotiable, restrictive covenants on the use of proceeds may be inserted in the definitive agreements and enforced under Indian contract law. Misuse may also give rise to investor remedies such as indemnity or rescission. |

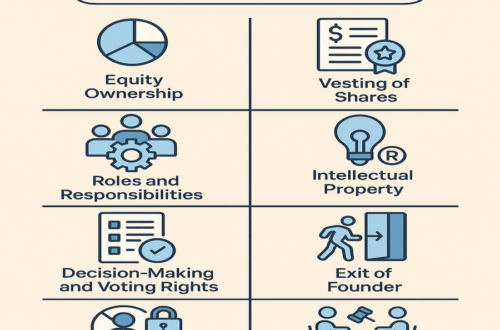

| Shareholding Pattern (Fully Diluted Basis) | “Fully diluted basis” includes all outstanding convertible instruments and ESOP pools. Cap tables must be updated in board and shareholder filings, and any misstatement may attract penal consequences under the Companies Act. |

| Use of Proceeds | Though commercially negotiable, restrictive covenants on use of proceeds may be inserted in the definitive agreements and enforced under Indian contract law. Misuse may also give rise to investor remedies such as indemnity or rescission. |

| Definitive Agreements Timeline | Enforceability of the obligation to execute definitive agreements depends on whether the term sheet creates an enforceable obligation to negotiate in good faith. Indian courts generally do not enforce “agreements to agree” unless intent and conduct evidence consensus (Zostel v. OYO, Delhi HC, 2025). |

| Conditions Precedent (CPs) | CPs must be clearly defined. Non-satisfaction of CPs renders the investment incomplete. Companies must be cautious to comply with regulatory CPs (e.g., FDI reporting to the RBI, Competition Commission approval under Section 5 of the Competition Act). |

| Board and Observer Rights | Investors commonly seek nomination rights under Section 161 of the Companies Act. Nominee directors must comply with fiduciary duties under Section 166. Observer rights do not carry voting power and are typically contractual. |

| Reserved Matters | These give veto rights to investors and are enforceable as shareholder covenants. However, to ensure enforceability under corporate law, reserved matters must be mirrored in the Articles of Association (AoA) pursuant to VBHC v. Suraksha Realty. |

| Exit Rights (IPO, Buy-Back, Third-Party Sale) | Exit rights must comply with Indian securities law. Buy-back must follow Section 68 of the Companies Act and applicable SEBI rules. IPO-related rights are contingent and not enforceable per se. |

| Put Option / Drag-Along | Put options are valid if structured in compliance with RBI’s 2014 circular and Supreme Court guidance in MCX Stock Exchange v. SEBI (2012). Drag-along clauses must be backed by proper board/shareholder authorizations and reflected in AoA. |

| Anti-Dilution Protection | Full ratchet and broad-based weighted average are standard mechanisms. Must be consistent with Section 62 of the Companies Act and recorded in the SHA and AoA to be enforceable. |

| Founder Vesting | Contractual vesting is enforceable through call option structures or escrow arrangements. However, clawback of already allotted shares without proper documentation may be challenged under the Companies Act. |

| Founder Lock-In / Non-Transferability | Enforceable under private contract law. Must be reflected in AoA for third-party enforceability and to avoid conflict with the Companies (Share Capital and Debentures) Rules, 2014. |

| Employment Agreements | Founders are typically bound by employment agreements with IP assignment, non-compete and non-solicit clauses. Indian courts have generally upheld such clauses during employment, but post-employment restraints are enforceable only if reasonable (Section 27, Indian Contract Act, 1872). |

| Pre-Emptive Rights | Pre-emption on issuance is enforceable contractually and should be included in AoA under Section 62(1)(c) to avoid challenges from other shareholders. |

| Right of First Refusal (ROFR) / Tag-Along | Enforceable as contractual rights and, where necessary, in the AoA. The VBHC judgment mandates incorporation in the AoA for enforceability against third parties. |

| Drag-Along Rights | Must be contractually binding and backed by shareholder resolutions. For enforceability, particularly in a transfer or exit scenario, these rights should be reflected in the AoA and supported by power of attorney clauses. |

| Dispute Resolution | Arbitration clauses must comply with the Arbitration and Conciliation Act, 1996. Indian courts have enforced arbitration even for term sheets if the clause is unambiguous (Welspun v. Brilliant Corporate Services, 2022). Choice of law and jurisdiction must be specific. |

| Information and Inspection Rights | These rights support investor oversight and should include access to MIS, audited financials, and business plans. Enforcement lies in breach remedies or as CPs for subsequent funding tranches. |

| Expense Allocation | Standard practice is for companies to bear legal and diligence expenses. While enforceable, best practice includes a cap or pre-approval process to limit risk of dispute. |

| Confidentiality and Exclusivity | These are usually among the few binding clauses in an otherwise non-binding term sheet. Indian courts have upheld such clauses even in non-binding term sheets (Delhi HC, Welspun Case). |

| Indemnity and Representations | Must be specific, time-bound, and liability-capped. Courts in India uphold indemnities as long as they do not override statutory liabilities or violate public policy. D&O insurance is advisable for risk mitigation. |