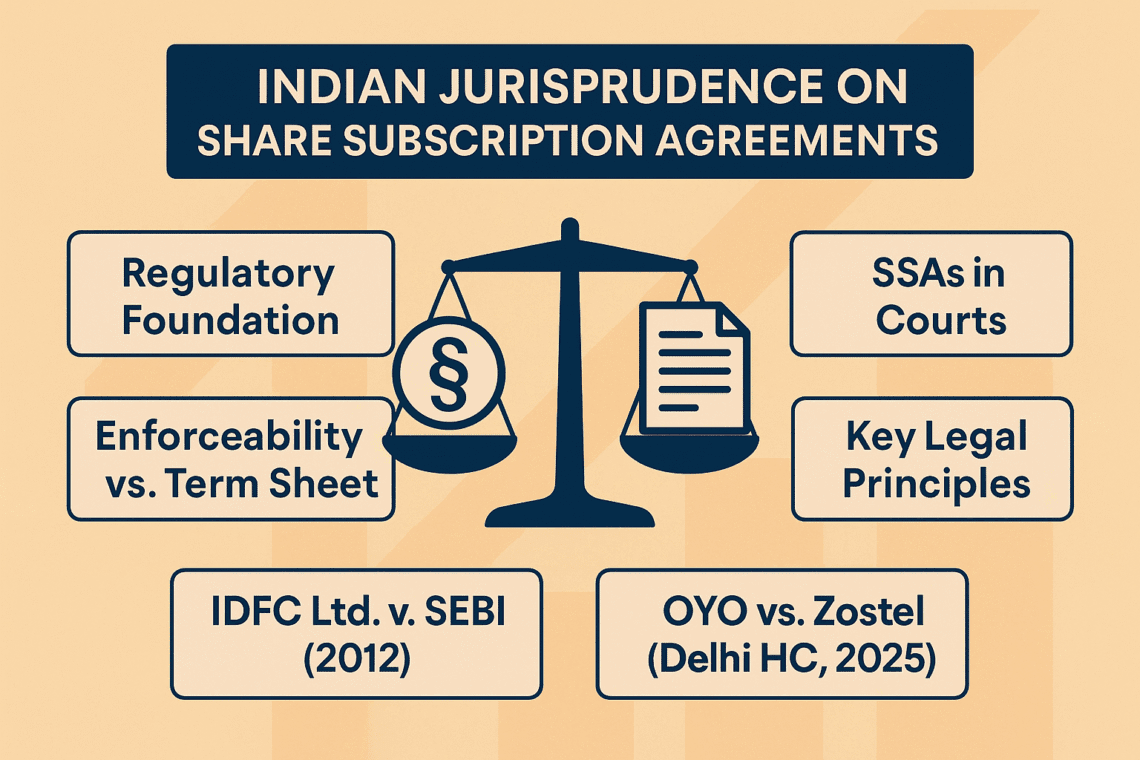

In PE/VC investing, the term sheet signals interest, but it’s the Share Subscription Agreement (SSA) that crystallizes a transaction. The SSA marks the transition from intent to a legally enforceable commitment, especially under Indian law.

Why the Share Subscription Agreement Matters?

The SSA is the first binding contract between the investor and the company. Once signed, it triggers:

- Companies Act, 2013 obligations under Section 42 (private placement) and Section 62(1)(c) (preferential allotment), involving PAS‑4 offer letters and Form PAS‑3 reports.

- FEMA (NDI) Rules, 2019 compliance for foreign investments—including pricing checks and FC‑GPR filings.

In IDFC Ltd. v. SEBI (SAT, 2012), the SAT held that private share subscription agreements must comply with placement norms—no exceptions for “private” deals.

The primary reason an SSA matters is clarity and certainty. It records the number of shares, price per share, payment timelines, conditions precedent (such as regulatory approvals, board/shareholder resolutions, or due diligence), and warranties. Without a written SSA, disputes could easily arise around whether the company was obliged to issue shares, at what valuation, or on what terms. Indian courts have repeatedly stressed the importance of clearly drafted contracts in avoiding unnecessary litigation. In Vodafone International Holdings v. Union of India (2012), while not an SSA case, the Supreme Court underscored the principle that investment structures must be respected if they are clearly documented and legally compliant.

A second rationale is the protection of investor rights. An SSA is typically signed alongside a Shareholders’ Agreement (SHA). While the SHA governs post-investment rights (like governance, veto rights, and exit mechanisms), the SSA secures the investor’s entry. In IDBI Trusteeship Services Ltd. v. Hubtown Ltd. (2016), the Bombay High Court upheld contractual protections for investors, recognizing the binding force of such agreements. Though the case was about debenture subscription, the principle applies equally to SSAs: contractual commitments in financing arrangements are enforceable if properly recorded.

Third, an SSA matters for regulatory and compliance purposes. Foreign direct investment (FDI) in India, for instance, must comply with the Foreign Exchange Management Act (FEMA), sectoral caps, and pricing guidelines. The Reserve Bank of India (RBI) requires supporting agreements like SSAs for reporting inflows and allotment of shares. Courts have also emphasized the enforceability of FEMA-compliant agreements, such as in Union of India v. Reliance Industries Ltd. (2018), where compliance with regulatory frameworks was key to interpreting contractual rights.

Finally, an SSA ensures risk allocation. By including representations, warranties, and indemnities, it ensures that the investor is protected against hidden liabilities. The absence of such an agreement could expose both parties to future disputes about the scope of obligations.

Key Clauses in Share Subscription Agreements

| Clause | Commentary |

| Subscription & Payment Terms | Specifies the class, number, and price of shares, and payment schedule. In cross-border deals, strict adherence to FEMA (NDI) Rules, 2019 pricing guidelines and timely filing of Form FC‑GPR is essential. Under Sections 42 and 62 of the Companies Act, incorrect pricing or filing lapses risk penalties and invalidation of allotment |

| Conditions Precedent (CPs) | Lists conditions—such as board/shareholder approvals, regulatory filings, IP assignments, and due diligence—required before closing. These are legally binding, and failure to satisfy them allows investors to terminate or delay the transaction . |

| Tranche Structure | When funding is tied to milestones, ambiguity in definitions can cause disputes and stalled investments. Each milestone should be clearly defined and measurable to ensure enforceability . |

| Representations & Warranties | Legal assertions by the company (and often promoters) about business, compliance, contracts, IP, etc. Courts regard these as enforceable obligations—breach can trigger indemnity—but require careful drafting, survival periods, and caps . |

| Indemnity | Investors’ protection against losses from breach of reps or CPs. Indian courts uphold indemnity clauses when reasonable in scope and duration, provided they do not violate public policy . |

| Use of Proceeds | Clearly tracks investor’s expectations on fund deployment, offering protection against misuse under Indian contract principles. Though not expressly mandated by law, it provides recourse in case of misuse . |

| Anti‑Dilution & Pro‑Rata Rights | Ensures investors can maintain stake through down‑round protection and future issuance rights. These must align with the Companies Act and be consistent with provisions in the Articles of Association (AoA) . |

| ROFR / ROFO / Tag‑Along / Drag‑Along | Governs share transfer rights. Per precedent like VB Rangaraj, these rights must be incorporated into the AoA to be binding on all shareholders . |

| Put & Call Options | Investor options to propose share sales back to the company or founder. Must carefully define pricing mechanisms and timelines. Courts (e.g., Banyan Tree v. Axion Cordages) uphold clear put/call rights . |

| Founder Lock‑In / Vesting | Ensures founders’ early commitment through vesting schedules or escrow. Legally enforceable via call options or escrow trust, subject to clear documentation . |

| Confidentiality & Exclusivity | Prevent founders from seeking rival funding or sharing sensitive data during SSA period. Courts have enforced such clauses even when inserted in non-binding agreements . |

| Board & Observer Rights | Investor lands board seat(s) per Section 161 of the Companies Act and nominates director(s) with fiduciary duties under Section 166. Observers have access but no voting power . |

| Dispute Resolution & Governing Law | Arbitration under the Arbitration & Conciliation Act, 1996 is enforceable—especially with clear seat and rules. Courts uphold international seats when clearly stated (e.g., GMR v. Doosan) . |

| Termination & Default Events | Defines when either party can step back—e.g., unfulfilled CPs or material breaches. To be valid, terms must be fair and not arbitrary per Sec 23 of the Contract Act . |

For practical reference of readers, we have attached a model share subscription agreement below:

Pages: 1 2

One comment on “Understanding a Share Subscription Agreement”