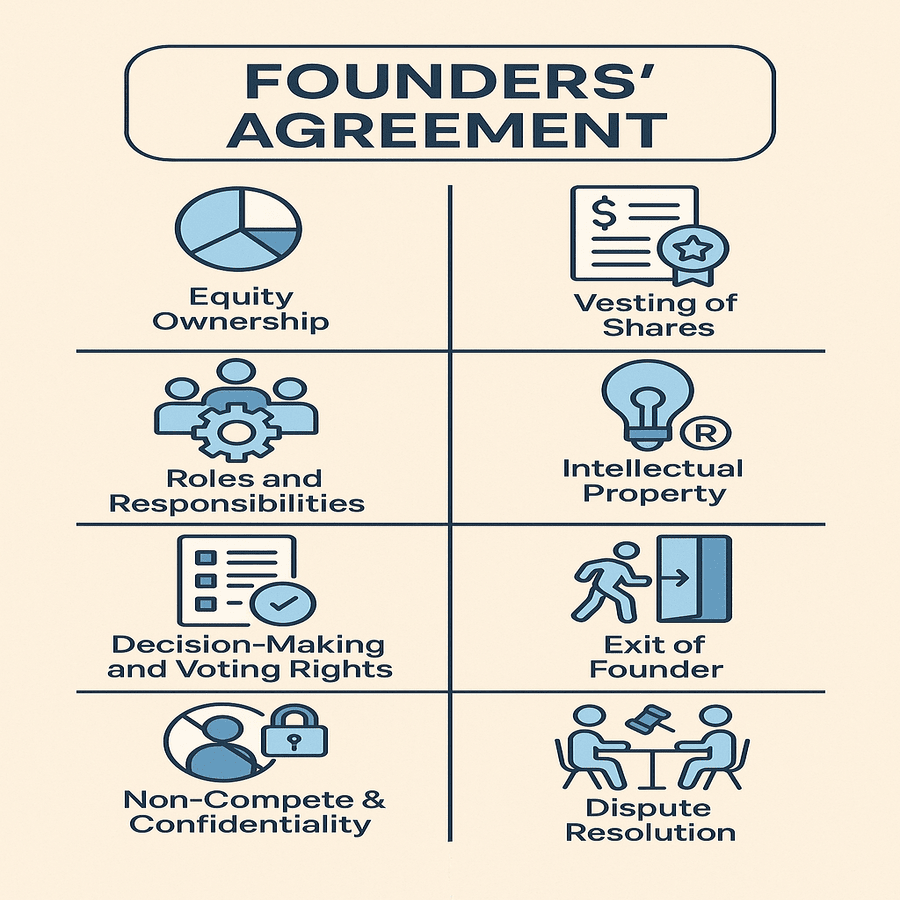

In this article, I’ll walk you through the key clauses every ideal Founders Agreement should include. For reference, you can find a detailed model Founders’ Agreement by Track Deal at the end of this article.

Founders play a critical role in shaping a startup’s journey. Their relationship becomes even more important when raising Angel or Venture Capital funding. According to Noam Wasserman, author of The Founder’s Dilemma, founder conflicts cause nearly 65% of startup failures. In India, two high-profile disputes between founders have significantly dented investor confidence in the startup ecosystem.

Bharat Pe: Ashneer Grover v Bhavik Koladiya

The dispute began after an audio recording surfaced online, allegedly featuring Ashneer Grover threatening a Kotak Mahindra Bank employee. This incident soon escalated into a share transfer dispute. Co-founder Bhavik Koladiya claimed that Grover failed to pay for 2,447 equity shares of BharatPe, which Grover had received in 2018 under an oral agreement.

The Viral Fever (TVF): Prashant Raj v Arunabh Kumar

Another notable instance of founder conflict occurred at TVF, which was founded by Arunabh Kumar and later joined by Prashant Raj. Raj came on board as a pro bono co-founder, with an oral agreement that he would receive 4% equity in TVF as compensation for his contributions. In 2014, Raj exited the company and later sued Kumar over the alleged breach of that agreement.

Importance of Founders Agreement

In both cases, the disputes stemmed from oral agreements, legal under the Indian Contract Act, 1872. However, relying on oral agreements in such critical matters is risky, as they often lack clarity and fail to establish a definite understanding between the parties involved.

Drafting Considerations for a Founders Agreement

| S.No | Matter(s) | Relevant Clause(s) |

| Strategy | ||

| 1. | When multiple founders collaborate on a business venture, clarity around each founder’s personal objectives and their shared long-term vision helps avoid future misalignment. | This must be addressed by the founders in the recitals. |

| Ownership | ||

| 1. | The division of the percentage of company among founders typically depends on their respective contributions and the nature of their roles within the company. It is therefore essential to explain the basis of this division clearly | The Founders Agreement must include a clear Ownership Structure Clause that sets out each founder’s percentage holding in the company. Defining the equity split from the outset helps prevent future disputes and ensures transparency in each founder’s stake and contribution. |

| 2. | The division of the percentage of the company among founders typically depends on their respective contributions and the nature of their roles within the company. It is therefore essential to explain the basis of this division clearly | The Founders Agreement should include a Duties and Obligations Clause that outlines each founder’s responsibilities, whether individual or shared. This clause should also cover the founder’s exclusive commitment to the venture, stating that no founder may engage in any other business or professional activity without the company’s prior written consent. |

| 3. | Some startups, especially those that are capital-intensive, may require founders to make financial or non-financial contributions at the outset. It is crucial to document these contributions, as they can directly impact the division of ownership in the company. | The Founders Agreement should include a Capital Contribution Clause, specifying the nature and extent of each founder’s contribution—whether equal or unequal. This may include monetary contributions, intellectual property, or a combination of both. All such arrangements must be clearly recorded, along with their corresponding effect on each founder’s equity stake. |

| 4. | Founders often expect one another to remain actively involved in the company for a minimum period, especially during its critical growth phases. This ensures that no founder exits prematurely—such as during a key fundraising round or product launch—leaving the team short-handed. | To address this, the Founders Agreement can include a Vesting of Shares Clause, which ties equity ownership to continued participation. For example, a founder’s equity may vest over four years, beginning from an agreed “vesting start date.” A typical structure is monthly vesting of 1/48th or annual vesting of 1/4th of the total shareholding. This approach incentivizes long-term involvement and protects the company if a founder leaves early. The importance of such a clause was highlighted recently when several co-founders of PharmEasy exited the company. A well-drafted vesting clause helps manage such transitions while safeguarding the interests of remaining founders and investors |

| Management | ||

| 1. | Effective management of a startup begins with handling day-to-day operations and making key business decisions. For this, it is essential to allocate voting power among the founders. In addition to voting and distribution rights, the agreement should address how benefits accrued by the company will be shared among the founders. | The Founders Agreement should include a Remuneration and Benefits Clause that clearly sets out each founder’s compensation, including salary, bonuses, and other benefits. It should also provide flexibility to revise these terms in the future, subject to board or mutual founder approval, in line with the company’s growth and financial position. To prevent misuse of company resources, this clause can also include a provision stating that all benefits and compensation are strictly personal to the founder and shall not extend to family members, unless such relatives are formally employed by the company. This safeguard ensures transparency and protects the company from potential misappropriation. For instance, in the BharatPe controversy, allegations surfaced that Ashneer Grover’s wife had used company funds to finance personal luxury expenses. Clauses like these are designed to prevent such misuse and reinforce fiduciary discipline among founders. |

| 2. | The compensation or salary component of the founders along with the flexibility to modify it in the future. | The compensation or salary component of the founders, along with the flexibility to modify it in the future. |

| 3. | If a founder decides to leave the company, the exit must be managed in a structured and transparent manner. | The Founders Agreement should include a Founder Exit Clause, which is typically linked to the vesting schedule. This clause can provide for the buyback of the departing founder’s shares by the company or the remaining founder(s). Alternatively, if a new founder is to be brought in, they may acquire the exiting founder’s shares as part of the transition. To protect the company’s integrity and ownership structure, this clause should also restrict the exiting founder from selling their shares to any third party without the prior consent of the company or the remaining founders. Such safeguards ensure continuity, prevent unwanted outsiders from gaining control, and allow for smoother transitions during founder exits. |

| 4. | Whether founders can launch other startups while working on the current venture depends on their mutual understanding and the specific needs of the business. | To avoid conflicts of interest, the Founders Agreement should include an Exclusivity and Non-Compete Clause. This clause may restrict founders from engaging in other business ventures or activities that compete with the company during their involvement. While some founders may agree to complete exclusivity, others might allow room for parallel ventures, especially if they are in unrelated sectors. In either case, the clause should clearly define what is permitted and what constitutes a conflict, ensuring that the primary focus and loyalty remain with the startup unless otherwise agreed in writing. |

| 5. | If the startup is unable to meet its goals and the founders decide to discontinue the business. | The Founders’ Agreement should include a Termination Clause to guide the process. Two possible scenarios may arise: Partial Exit – Some founders may wish to exit while others want to continue. In such cases, the exiting founders should do so in accordance with the Founder Exit Clause and Vesting Clause, ensuring they do not violate any ongoing vesting conditions. Complete Dissolution – If all founders mutually agree that the business is no longer commercially viable, the company should be wound up in accordance with applicable laws and regulatory procedures. This includes complying with relevant provisions under the Companies Act, 2013 and other regulatory frameworks governing closure. A well-drafted termination clause provides clarity and legal certainty during such difficult decisions, allowing for an orderly exit and protection of stakeholder interests. |

| 6. | Disagreements may arise between founders either regarding the interpretation of the Founders’ Agreement or during critical management decisions | To address such situations, the agreement should include a Dispute Resolution Clause that outlines a clear mechanism for resolving conflicts. This clause can specify a stepwise process—such as internal negotiation, followed by mediation or arbitration—before approaching courts. Choosing arbitration under the Arbitration and Conciliation Act, 1996, with a specified seat and language, is a common and efficient route for startups. A defined dispute resolution process ensures that disagreements are handled constructively without disrupting the business. |

Track Deal’s Draft Founders Agreement

A well-drafted Founders Agreement lays the foundation for a stable and transparent relationship between co-founders. By addressing key aspects such as ownership, responsibilities, exit mechanisms, and dispute resolution, it helps prevent misunderstandings and protects the long-term interests of the startup. Founders are encouraged to invest time in customizing this agreement to reflect their unique goals and working dynamics. For reference, a detailed model Founders Agreement is provided at the end of this article by Track Deal.

Pages: 1 2

Thank you for the boilerplate template. This is helpful!