May 2025 turned out to be a vibrant month for private equity and venture capital activity in India, with over $1.15 billion deployed across 18+ deals. Investment momentum spanned across sectors—from healthcare and logistics to entertainment and consumer brands—underscoring the resilience and breadth of India’s growth story.

A major highlight was PB Healthcare Services’ $218 million raise, signaling a strong shift into healthcare infrastructure by digital insurance giant PB Fintech. Porter’s $200 million fundraise, which pushed it into the unicorn club, highlighted continued investor confidence in tech-led logistics platforms. Consumer-focused startups like Lahori and The Good Bug also attracted significant capital, reflecting the enduring appeal of homegrown health and wellness brands. Meanwhile, Universal Studios’ proposed $794 million partnership with Bharti Real Estate added global flavour to the month, cementing India’s position as a strategic market for immersive retail and entertainment spaces.

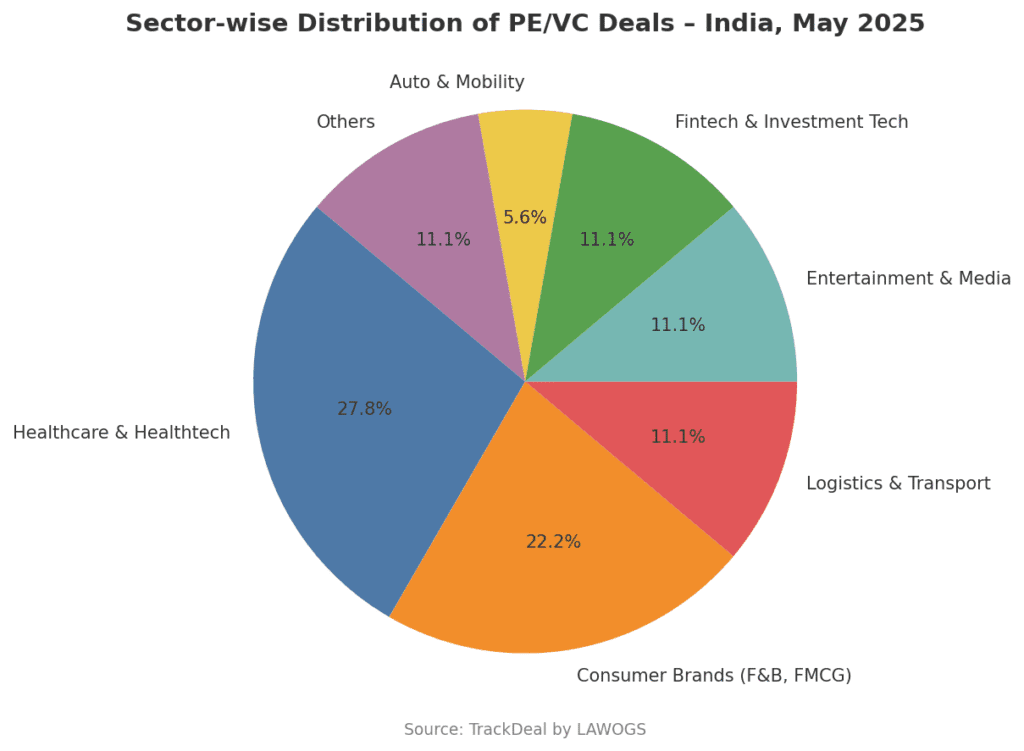

The adjacent pie chart illustrates the sector-wise distribution of May’s transactions, clearly showing that Healthcare & Healthtech dominated with 28% of the deals, followed closely by Consumer Brands at 22%. Logistics & Transport accounted for a solid share, driven by Porter’s fundraise and Fleetx’s follow-on round. Investment activity also picked up in Entertainment, Fintech, and Auto-tech, each reflecting niche yet emerging themes in the Indian market. The “Others” segment includes early-stage bets in astrology, local services, and hyperlocal platforms, pointing to growing investor curiosity in culturally relevant and operationally lean models.

Private Equity/ Venture Capital Deal Table: May 2025

What This Means for India’s Private Equity/ Venture Capital Investment Climate

The diversity seen in May’s deal activity highlights a balanced investor strategy: long-term infrastructure and capital-intensive projects on one hand, and agile, tech-enabled growth plays on the other. Investors appear increasingly aligned with sectoral shifts—backing not just scalable platforms, but also founder-led ventures with strong brand recall and wellness-oriented propositions. Several rounds also involved secondary exits, improving liquidity across the ecosystem and offering confidence to early-stage backers. Structured capital, as seen in BlackRock’s proposed investment in Bira91, hints at a maturing Indian deal market that’s ready to experiment with more sophisticated instruments. As global headwinds persist, May’s data reinforces the view that India remains an attractive, multi-sector investment destination—fuelled by demographic depth, consumer demand, and investor adaptability.

Pages: 1 2

Interesting deal insights, waiting for more nuanced analysis in future editions!